As we move through 2025, sustainability is cementing itself as a standard for the building materials industry, transforming into a procurement requirement. Buildings account for ~34% of global CO₂ emissions and ~32% of total energy use (IEA, 2024), and regulators are pushing hard to reduce that footprint. The message is clear: the products you stock today will decide whether you stay competitive tomorrow.

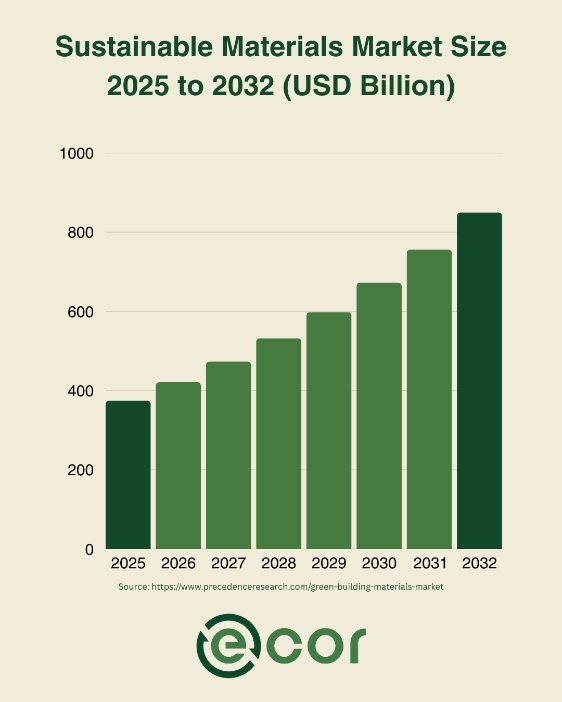

The market signals confirm this shift. The global green building materials market is estimated to be $374.67 billion and is projected to hit $894.74 billion by 2032 (Precedence Research, 2024). Growth is being fueled by policy mandates, corporate climate goals, and investor scrutiny, all of which directly affect the purchasing standards fabricators must meet.

Policy is the biggest driver. In the U.S., the General Services Administration (GSA) now requires low-embodied-carbon concrete, steel, asphalt, and glass for federal projects (GSA, 2024). In Europe, the Carbon Border Adjustment Mechanism (CBAM) enters its definitive phase in 2026, imposing carbon costs on imported cement, steel, and aluminum (European Commission, 2023). For purchasers, these rules transform carbon performance from a “nice-to-have” into a baseline for bid eligibility.

At the same time, transparency tools are reshaping procurement. BuildingTransparency’s EC3 platform now hosts more than 157,000 Environmental Product Declarations (EPDs), used by over 52,000 professionals across 76 countries (BuildingTransparency, 2024). EPDs are quickly becoming standard submittals, which means that buyers must increasingly prioritize materials backed by verified carbon data alongside cost and performance.

Health is also driving material choices. The EPA reports indoor air can be 2–5 times more polluted than outdoor air (EPA, 2024), with people spending up to 90% of their time indoors. Materials that avoid VOCs, formaldehyde, and toxic adhesives are no longer niche and rather are essential to meet client wellness standards.

This is where ECOR provides an advantage for fabricators. ECOR panels are made from 100% recycled and rapidly renewable fibers with no added resins or toxic chemicals. They carry SCS Indoor Advantage™ Gold certification, ensuring compliance with both U.S. and EU indoor air standards. Produced through a closed-loop, localized process, ECOR minimizes transport costs and carbon impact while delivering durable, high-performance alternatives to conventional composites.

The next five years will bring tighter embodied carbon limits, portfolio-level procurement standards, and wider adoption of Buy Clean policies. Fabricators who move early by sourcing low-carbon, EPD-backed, and non-toxic materials will be best positioned to win projects and to protect margins. ECOR offers a future-ready solution that aligns with these shifts and helps fabricators deliver on both compliance and performance.